How Much Minimum Down Payment is Required for Home Loan? – Whenever you go around looking for a property to purchase, there are three things that you need to consider. Firstly, how much the property cost, the amount you can pay as a down payment, and finally, the home loan amount you can get. Well, the last two considerations have an inverse relationship with each other. The more loan amount you are eligible for, the lesser down payment you need to pay. If you have more money to pay as a down payment, you will have to take a lesser amount as a loan to buy the property.

Table of Contents

Explanation of a Down Payment

Every lending institution has criteria for determining what percentage of the property value they will pay for as the loan amount when you apply for a home loan. You must bear the remaining cost of the property as the buyer. The remaining amount you pay from your pocket is the down payment for the property, which usually happens at the beginning of the purchase process.

The Reserve Bank of India and the National Housing Board have set the maximum limit of loan amount percentage that any money lending institute can provide based on the property value, and the terms are:

- For a property value of INR 30 lakhs and below, the maximum loan percentage is 90%.

- For a property value from INR 30 lakhs and above up to INR 75 lakhs, the maximum loan percentage is 80%.

- For a property value of more than INR 75 lakhs, the maximum loan percentage is 75%.

Other Factors Determining the Home Loan Amount Percentage

Apart from the set maximum percentage limit, there are other factors of the loan applicant that best home loan lenders consider for determining the home loan amount percentage, like:

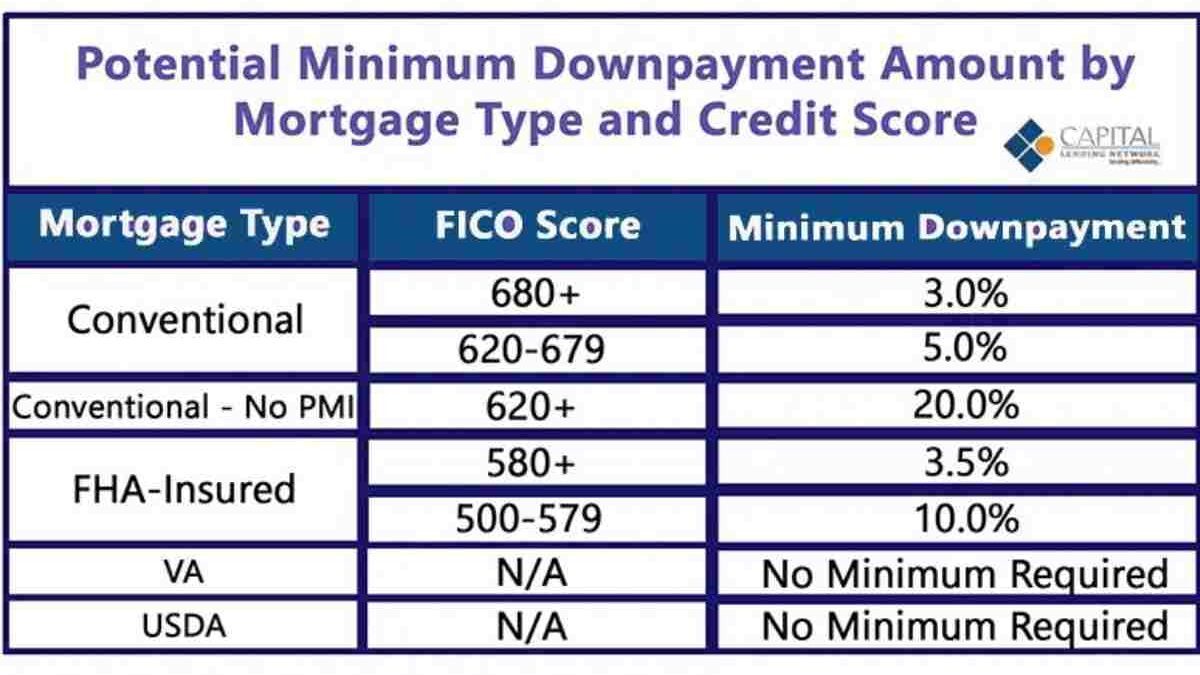

- Credit scores of the loan applicant.

- Monthly income of the loan applicant.

- Value of the property which is getting purchased.

- Age of the loan applicant.

- Income Tax Returns filed in the past by the applicant.

- The nature of employment of the loan applicant.

- Any existing debts or loans that the loan applicant has.

Measures for Planning Your Down Payment

There are specific measures that you can take to plan for the down payment of an instant home loan:

1) Plan and Start Saving from Before:

If you are planning on buying a property or building a house, it is best to prepare for it in advance, especially when you have to take a loan from a financial institute. Since the money lending institutions are not allowed to give a loan more than the specified loan amount percentage, there will be a portion of the property cost or building expenses that you will have to bear on your own. So plan and save for this down payment amount you have to pay before.

2) Identify the Right Money Lending Institution:

You must identify the right money lending institution before you apply for a housing loan because they have to match your requirements. For example, some money lenders can give you 90% funding, whereas some can only give you only 75% of the property value as funds. Therefore, you must match this with how much you must make a comfortable down payment for the property without affecting your financial position. Consequently, you should choose the one that gives you the loan amount you would require to purchase the property.

3) Opt for Part Payment of the Down Payment:

If you want to purchase a property still under construction, then some real estate builders and financial institutes providing the best home loan allow you to make part payments of the down payment. This option is available primarily for this type of construction-in-progress project because payment needs to be made at every phase as the project progresses. Thus, this arrangement helps you make smaller down payments for every installment the financial institution pays towards the project completion phase.

4) Arrange the Down Payment by Taking a Secured Loan:

It is better to take a secured loan against your investments like life insurance policies, mutual funds, fixed deposits, or any other asset to make the down payment. These secured loans come at very low-interest rates because you pledge collateral to take the loan. You can use this low-interest loan amount to make the down payment along with the cheapest home loan possible, and you don’t have to eat into your hard-earned savings.

Considerations of Making a Low-Down Payment for Your Home Loan

When you make a low-down payment for your housing loan, the following things happen:

- The initial money that you need to organize becomes less, making it less stressful financially.

- The savings that you accumulate remains primarily intact for better liquidity.

- You can use any extra money for better investment planning than paying a huge down payment.

- The housing loan amount increases, which raises your borrowing costs as you have to pay more interest.

Considerations of Making a High Down Payment for Your Home Loan

If you make a high down payment for your housing loan, the following things happen:

- Making a high down payment lowers your principal borrowing amount, which helps lenders offer you the lowest-interest home loan.

- A high down payment amount even helps you save money on interest as the duration of your loan repayment reduces, which means less interest.

- It helps you to reduce your financial obligation, in turn, have a less stressful financial situation.

- There may be an initial liquidity crunch for you as you may have had to use your savings to pay the higher down payment amount.

Conclusion

The question of how much down payment you must pay for a home loan depends on many factors. It varies from person to person and their financial situation or position. If you have a lot of liquidity and savings that you can spare to make a sizable down payment, it would be best to do so as the borrowing cost will become less. However, if you cannot pay much of a down payment amount, it would help if you got a lending institution that can give you the maximum loan amount percentage.