A P45 is a critical document bosses provide to staff upon finishing service in the United Kingdom. It contains vital details about the worker’s income, taxes paid, and tax code. Considerate that the P45 form is vital for employers and staff to ensure accurate tax controls and obedience to HMRC rules.

Table of Contents

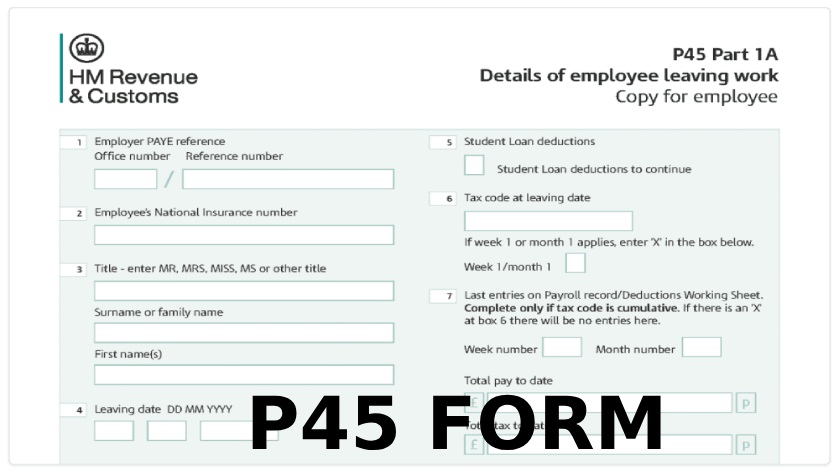

Introduction to P45 form

A P45 form, also known as “Details of employee leaving work,” is a document issued by employers in the United Kingdom to employees who cease employment. It records the individual’s income, taxes paid, and tax code during their employment period.

Key components of the P45 form

The P45 form consists of four parts:

Submitted to Her Majesty’s Revenue and Customs (HMRC) by the former employer.

Retained by the employee for their records.

These are given to the new employer for tax and employment registration purposes.

How the P45 form works

When employees leave a job, their former employer provides them with a P45 form. This document contains the employee’s income, tax deductions, and tax code up to the termination date. The new employer uses the information from Parts 2 and 3 to set up the employee’s tax and employment records.

The P45 form comprehensively records the individual’s financial interactions with their previous employer. It includes crucial details such as total earnings, tax paid, and benefits received during employment. Additionally, the form outlines the tax code applicable to the employee, which aids the new employer in accurately deducting taxes from the employee’s salary.

Accurate data on the P45 form is essential for the employee and employer. For the employee, it ensures that their tax contributions are correctly accounted for, preventing overpayment or underpayment of taxes. For the employer, it streamlines the process of onboarding new employees by providing vital financial information required for tax compliance.

In cases where discrepancies or errors are identified on the P45 form, the employee must notify their former employer promptly. Employers can then rectify any inaccuracies and issue corrected forms if necessary. This ensures that the employee’s financial records remain accurate and up-to-date, minimizing potential tax calculations and compliance issues.

Overall, the P45 form is a critical document in the transition between jobs, facilitating smooth tax processes and ensuring financial transparency for employees and employers.

Using the P45 form for tax purposes

The P45 form plays a crucial role in the taxation process

It helps calculate accurate tax deductions for the employee’s new job.

Provides information on outstanding student loans and entitlement to tax rebates.

They are used for claiming Job Seeker’s Allowance (JSA) and tax refunds.

Pros and cons

PROS

Clear Documentation:

The P45 form documents an employee’s earnings, tax contributions, and benefits received during employment.

Streamlined Tax Processing:

It streamlines the tax processing for employees and employers, reducing the likelihood of errors in tax calculations.

Employee Rights Protection:

The P45 form records an employee’s financial interactions with their employer, protecting their rights in case of disputes or discrepancies.

CONS

Potential Loss

If an employee loses their P45 form, it can lead to delays in tax processing and may require additional steps to obtain a replacement or rectify errors.

Employer Responsibility:

Employers are responsible for issuing accurate and timely P45 forms to departing employees, which can be burdensome in cases of high turnover.

Emergency Tax Risk:

Failure to provide a P45 form to a new employer may result in the employee being emergency taxed until the necessary documentation is provide, leading to potential financial inconvenience.

Importance

For employees, the P45 form ensures that their tax contributions are accurately record and that they receive any refunds to which they are entitle. Employers use the form to comply with HMRC regulations and facilitate the smooth transition of employees between jobs.

The P45 form serves several important purposes for both employees and employers:

Accurate taxation:

It ensures that employees’ tax contributions are accurately record and report to HMRC.

Smooth transitions:

The P45 form facilitates seamless transitions between jobs by providing essential tax information to new employers.

Compliance:

Employers use this form to comply with HMRC regulations regarding tax reporting and employee record-keeping.

Claiming benefits:

It is require for claiming benefits such as Job Seeker’s Allowance (JSA) and tax refunds.

Tax rebates:

The information on the form helps individuals determine if they are entitle to tax rebates or refunds.

Preventing emergency tax:

Timely issuance of the form by employers helps prevent employees from being emergency tax by HMRC.

Overall, this form plays a vital role in the UK’s tax system, ensuring transparency, accuracy, and compliance in taxation processes.

Conclusion

The P45 form is an essential document in the UK’s tax system, providing vital information for employees and employers. Understanding its purpose and contents ensures smooth job transitions and accurate tax calculations. Employers and employees should familiarize themselves with this form to comply with HMRC regulations and facilitate efficient tax management.